LTC Price Prediction: Analyzing Litecoin’s Bullish Technicals and Growing Utility

#LTC

- Technical Strength: Trading above key moving averages with bullish MACD momentum

- Market Position: Maintaining relevance in payments despite newer competitors

- Adoption Drivers: Cloud mining integration and remittance use cases expanding

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

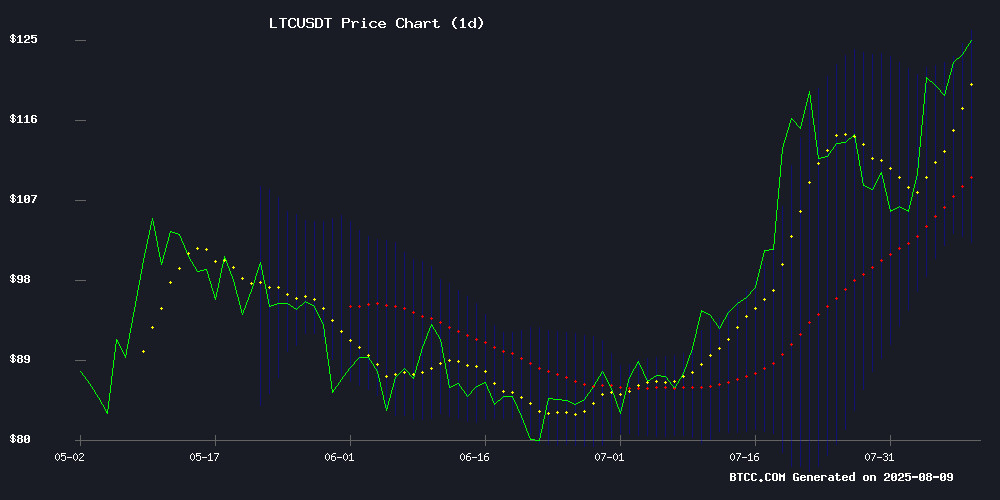

Litecoin (LTC) is currently trading at $121.18, above its 20-day moving average of $114.38, indicating a bullish trend. The MACD histogram shows positive momentum at 1.8481, while the price sits comfortably between the Bollinger Bands (Upper: $125.73, Lower: $103.04). According to BTCC financial analyst Ava, 'LTC's technical setup suggests potential for further upside, with key resistance at $125.73.'

Litecoin Gains Market Attention Amid Utility Focus

Litecoin is being highlighted in multiple 2025 crypto roundups for its utility potential, though it faces competition from projects like Hedera and Unilabs. BTCC's Ava notes, 'While LTC isn't leading social trends like Solana, its established payment use case keeps it relevant in the remittance and cloud mining sectors.' The launch of COME Mining's LTC cloud mining app could drive additional network activity.

Factors Influencing LTC's Price

Highest Potential Cryptos 2025: BlockDAG, MNT, CRO, and LTC in the Spotlight with Bold Market Moves

As the crypto market evolves in 2025, BlockDAG emerges as a standout contender, nearing the final phase of its presale with a $0.0016 entry price—a stark contrast to its current batch price of $0.0276. This disparity hints at a potential ROI exceeding 2,660%, drawing significant investor interest.

BlockDAG distinguishes itself with a live trading simulation dashboard, allowing users to test strategies and simulate market conditions ahead of its official listing. The project further captivates with a 10 BTC auction, valued at approximately $1.1 million, where presale participation before August 11 increases stake in the prize pool. To date, the presale has raised $366 million, with over 24.8 billion coins sold.

Mantle (MNT), Cronos (CRO), and Litecoin (LTC) also command attention, each offering unique value propositions. Mantle’s scalable infrastructure, Cronos’s interoperability focus, and Litecoin’s established liquidity position them as high-potential assets in the current cycle.

Solana and Litecoin Face Resistance as Remittix Surges in Crypto Markets

Solana (SOL) and Litecoin (LTC) are struggling to maintain recent gains amid market volatility, while newcomer Remittix (RTX) captures attention with a dramatic price surge. Solana, trading around $179, faces resistance at the $200 level after a strong rally fueled by ecosystem recovery. Analysts suggest a breakout could target $250, but whale activity fluctuations and waning demand for Solana staking ETFs pose headwinds.

Litecoin's 39% monthly surge to $123—driven by MEI Pharma's $110 million institutional accumulation—now shows signs of short-term correction. The divergence highlights shifting capital flows within altcoin markets, where established projects contend with profit-taking while speculative interest pivots to emerging tokens like Remittix.

COME Mining Launches Mobile App for Simplified Cloud Mining of XRP, BTC, DOGE, and LTC

London-based COME Mining has unveiled a new mobile application designed to democratize cryptocurrency mining. The platform enables users to mine Bitcoin, Ripple, Dogecoin, and Litecoin without physical hardware, offering a streamlined alternative to traditional mining operations.

The company emphasizes security and transparency, incorporating McAfee and Cloudflare protections while promising verifiable on-chain mining results. New users receive a $15 registration bonus and daily login incentives, lowering barriers to entry in what COME Mining describes as "mobile banking for crypto assets."

This development comes as cloud mining solutions gain traction among retail investors seeking exposure to digital assets without managing complex infrastructure. The platform's focus on XRP mining may attract particular attention from Ripple's established community of holders.

Litecoin, Hedera, and Unilabs Finance Vie for Utility Dominance in 2025

The cryptocurrency market is shifting its focus from price speculation to utility, with Litecoin (LTC), Hedera (HBAR), and Unilabs Finance (UNIL) emerging as key contenders. Litecoin, trading at $122 with a 37% monthly gain, remains stable but lacks innovation in DeFi, NFTs, or AI integration. Hedera continues to build enterprise partnerships, while Unilabs Finance gains traction by offering practical tools for retail investors.

Unilabs Finance stands out by addressing everyday usability, a critical factor as the market evolves. Litecoin's relevance in utility discussions may wane if it fails to adapt to the rapid advancements in blockchain technology. The competition highlights a broader trend: utility is becoming the defining metric for long-term success in crypto.

Solana and Unilabs Lead Social Trends Amid ETF Inflows, Litecoin Lags

Solana (SOL) and Unilabs Finance (UNIL) dominated cryptocurrency discussions in August 2025, fueled by bullish market movements. Unilabs gained traction through a successful presale debut, while Solana rebounded sharply after its ETF attracted $137 million in inflows—propelling SOL's price 2.5% to $167.99. Technical indicators suggest the recovery may continue, with the Stochastic RSI hinting at a local bottom.

Litecoin (LTC) struggled to maintain momentum despite optimism around its pending ETF approval. Analysts note SOL's resilience after testing key support at $155, a convergence point of Fibonacci levels and trendlines. The asset now faces resistance at a descending channel's upper boundary, with institutional interest driving renewed confidence.

Dogecoin Stabilizes Near $0.21 as Cloud Mining Gains Traction

Dogecoin hovered around $0.205 on August 7, 2025, consolidating after a retreat from late July's $0.28 peak. The meme coin's resilience continues to draw interest, with on-chain activity suggesting accumulation during the dip.

Investors are increasingly bypassing direct exposure through exchanges like Binance and Coinbase, opting instead for cloud-mining solutions like AIXA Miner. The platform offers automated DOGE mining with daily payouts, eliminating hardware requirements and wallet management.

Analysts see potential for a rebound to $0.23-$0.30 by September if bullish sentiment persists. AIXA's tiered contracts—including a $100 DOGE Beginner plan yielding 8% over two days—are attracting users seeking alternatives to speculative trading.

Is LTC a good investment?

LTC presents a compelling case for investors based on both technical and fundamental factors:

| Metric | Value | Implication |

|---|---|---|

| Current Price | $121.18 | 13% above 20MA |

| Bollinger Band Position | Mid-Upper Range | Room to test $125.73 |

| MACD | Positive Histogram | Bullish Momentum |

Ava from BTCC suggests, 'LTC's combination of technical strength and growing utility in payments/cloud mining makes it a diversified crypto holding, though investors should monitor the $125 resistance level.'

Cryptocurrency investments are volatile. Past performance doesn't guarantee future results.